I have a complex network $G=(V,E)$ from multivariate financial time series in which a single vertex $v_i$ represents the types of states corresponding to the combination of the fluctuations of the prices on a given time frame, a single edge $(v_i,v_j)$ denotes the transition from node $v_i$ to node $v_j$.

Then, I associated the graph $G$ with a first-order discrete-time Markov Chain as follows. The node set $$V(G)= \{v_1, v_2, \ldots, v_n\}$$ is the finite discrete state space and the edge set $$E(G) \subseteq V(G) \times V(G)$$ determined by the rule $e=(v_i, v_j) \in E(G)$ for $v_i, v_j \in V(G)$, corresponds to states’ transitions, and the edge weight is the transition probability between two states $v_i$ and $v_j$.

I have computed the eigenvalues of the transition matrix. All eigenvalues lie in a unit circle (except 1) and the spectral gap equals $1- |\lambda_2|=0.38$. The Markov chain is aperiodic (because self-loops exist) and is irreducible.

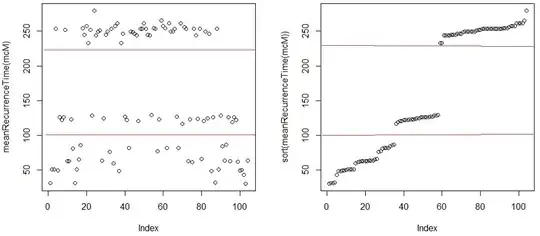

I have found the mean recurrence time (left graph) and then sorted mean recurrence time (right graph).

As on the left graph as on the right graph, one can see three 'clusters' (sets). I think that is not a typical case.

Maybe the transition matrix has a specific form?

As on the left graph as on the right graph, one can see three 'clusters' (sets). I think that is not a typical case.

Maybe the transition matrix has a specific form?

My question is: How to interpret obtained clusters (subgraphs) for Markov chain time characteristics? I am looking for a possible practical interpretation.

Edit 1.

I have plotted the original graph $G$ with tree 'clusters'. Then densities, diameters for subgraphs were calculated.

cluster vertexN edgeN density diameter

1 35 105 0.088235294 1.30119

2 23 12 0.023715415 1.00000

3 46 10 0.004830918 2.00000

Density of original graph is 0.0229649.

Refs

Meyn S P and Tweedie R L 2005 Markov Chains and Stochastic Stability